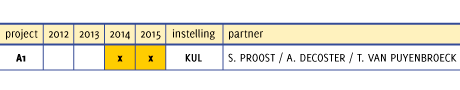

RESEARCH - TRACK A1

Fiscal federalism in the Belgian context

Output Track A1

Working papers

>SAS, W., DECOSTER, A., Het nut van dotaties in gelaagde staatsvormen: Een vergelijking van vereveningsmechanismen, KULeuven, 2013, 26 pp. (.pdf)

STEUNPUNTFBII/WP/A1/2013/1

> DECOSTER, A., SAS, W., De nieuwe Bijzondere Financieringswet van de 6de staatshervorming: Werden de beloften ingelost?, KULeuven, november 2013, 61 pp. (.pdf)

STEUNPUNTFBII/WP/A1/2013/2

>SAS, W., DECOSTER, A., Why commuting matters: Horizontal and vertical tax externalities in a federation, KULeuven, 2013, 33 pp. (.pdf)

STEUNPUNTFBII/WP/A1/2013/3

> SAS, W., Soft budget constraints in a federation: The effect of regional affiliation, KULeuven, 2014, 25 pp. (.pdf)

STEUNPUNTFBII/WP/A1/2013/4

Research theme

In this track the focus is on the following 3 research topics:

A. Study of the solidarity mechanisms in federal states: how do they function, how do they perform and how did they come about in terms of ex-post welfare distribution, efficiency, stability and stability. How were they received by the population? The political model allows to study the interaction between the intra-regional redistributive mechanisms and the interregional redistributive mechanism.

B. Study of the optimal allocation of fiscal powers in a federal state based on the marginal costs of public funds (MCPF). Literature recommends to transfer the tax responsibility to that government level showing the lowest MCPF. Minimizing the MCPF results in a 'fiscal gap', which is problematic in a world with non-benevolent governments. This study estimates the the MCPF for different types of taxes, relying on existing micro-simulation models for Flanders.

C. Study of the optimal allocation of the taxing powers to the different government levels. How can we assess the current Belgian institutional allocation of the taxation powers to the federal state and regions? Theoretically what would be the optimal allocation model, and to what extent does the Belgian set-up deviates from the optimal one? Today there is, yet, no integrated assessment (expenditure and revenues) of the effects of an alternative allocation of expenditures and taxes over government levels.

personnel:

Promoter: S.Proost & A.Decoster

Scientific personnel: Willem Sas